数字货币

板块简介

Profile of the plate

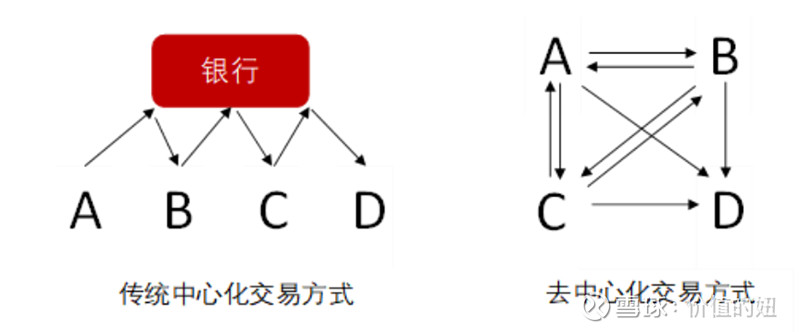

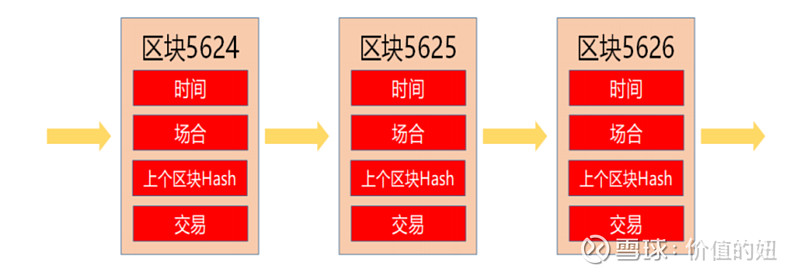

数字货币是区块链技术的产物,提到数字货币便离不开区块链技术。区块链(Blockchain)是指通过去中心化和去信任的方式集体维护一个可靠数据库的技术方案。从金融会计的角度来看,区块链可以看作是一个全节点参与的、高度可信的网络电子账本。对比微信、支付宝等应用系统的背后都有一个大型的中心数据库账本;区块链实行全网协作记账、核账,所有节点均参与记账。每次记账便会形成一个新的区块,即Block;每一个区块只能有一个节点进行打包,经解决一个数学难题(哈希算法Hash)判定信息合法后向全网进行广播,添加至上一区块的尾部并被其他节点记录。

Digital currency is the product of block chain technology. Digital currency is the technology that collectively maintains a reliable database by centralizing and detrusting it. From the point of view of financial accounting, the block chain can be seen as a highly credible network electronic account book with full node participation. Compare micro-letters, .

按照时间顺序由此形成的账本链条即为区块链(Blockchain)。为了激励记账者(即打包区块者),系统将给予一定的数字货币奖励,该过程即为挖矿。由于数字货币设计产生机制决定了数量是有限的,因此形成了数字货币具有价值的共识的基础。

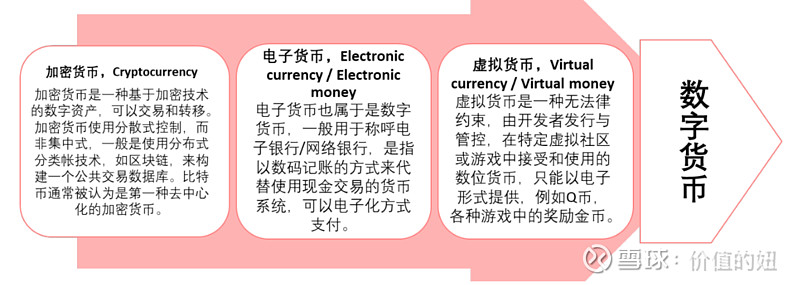

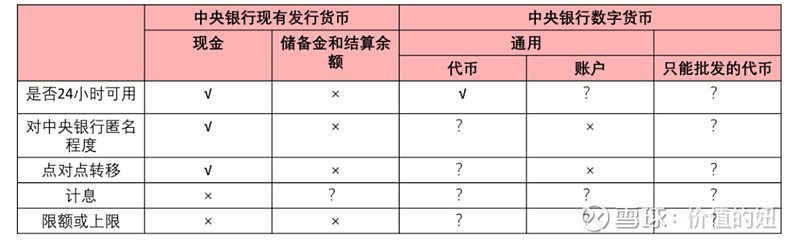

The chain of accounts thus formed in chronological order is a block chain ( 传统交易方式和去中心化交易方式 Traditional and decentralised trading 区块链交易方式 block chain trading 数字货币基于数字原理,通过特定的算法大量计算产生的网络虚拟货币。欧洲银行业管理局将虚拟货币定义为:价值的数字化表示,不由央行或当局发行,也不与法币挂钩,但由于被公众所接受,所以可作为支付手段,也可以电子形式转移、存储或交易。这便是数字货币最早的概念。随着技术的发展,数字货币概念也逐步延伸,不仅仅限制于使用区块链技术。在我国,官方意义上的数字货币指的是央行的法定数字货币,即中央发行的数字货币,属于央行负债,具有国家信用,与法定货币等值。 The European Banking Authority defines virtual currency as the digitalization of values, which is not issued by central banks or authorities or linked to French currency, but which, because accepted by the public, can be transferred, stored or traded as a means of payment or in electronic form. This is the earliest concept of digital currency. As technology develops, the concept of digital currency is gradually extended beyond the use of block-chain technology. 数字货币的起源 Origin of digital currency 在央行数字货币之前,对于非实体货币主要盛行如下三种概念:电子货币,虚拟货币和加密货币。虚拟货币虚拟货币主要有两类,一类是游戏币,另一类是门户网站或者即时通讯工具服务商发行的专用货币。加密货币主要用于互联网金融投资,也可以作为新式货币直接用于生活中使用。目前币圈流通的比特币、以太坊、EOS等币种都是加密货币。电子货币,是指用一定金额的现金或存款从发行者处兑换并获得代表相同金额的数据,通过使用某些电子化方法将该数据直接转移给支付对象,从而能够清偿债务。 Prior to central banks’ digital currency, the following three concepts prevailed for non-entity currencies: electronic currency, virtual currency, and encrypted currency. Virtual currency has two main types of virtual currency, one playing currency, and the other special currency issued by portals or instant communication service providers. 从电子货币、虚拟货币、加密货币到数字货币 From electronic, virtual, encrypted to digital 在前三种非实体货币的基础上,近年来衍生了一种新的概念,即,数字货币。根据国际清算银行的定义,“法定数字货币是法币的数字化形式,是基于国家信用、一般由一国央行直接发行的数字货币,是法定货币在数字世界的延伸和表现”,“不一定基于区块链发行,也可以基于传统央行集中式账户体系发行”。 On the basis of the first three non-entity currencies, a new concept has emerged in recent years, namely, digital currency. According to the Bank for International Settlements, “the legal numeric currency is a digitized form of French currency, based on national credit, which is usually issued directly by a central bank, and is the extension and performance of the legal currency in the digital world” and “not necessarily based on the chain of blocks, but also on traditional centralized central bank accounts”. 央行数字货币 Central Bank digital currency 我国央行将数字货币定义为“具有价值特征的数字支付工具”,是中央银行的负债,由中央银行进行信用担保,具有无限法偿性。中国人民银行数字货币研究所所长穆长春对于数字人民币则表示,“数字人民币是由人民银行发行的数字形式的法定货币。由指定运营机构参与运营并向公众兑换,以广义账户体系为基础,支持银行账户松耦合功能,与纸钞和硬币等价,具有价值特征和法偿性,支持可控匿名。” Our central bank defines digital currency as a “digital payment instrument with a character of value” and is a liability of the central bank, with credit guarantees by the central bank and unlimited legal compensation. The Director of the Digital Monetary Institute of the People’s Bank of China, Mu Changchun, said to the digital renminbi, “The digital renminbi is a legal currency issued in digital form by the People’s Bank. 2018年国际清算银行下属的支付和市场基础设施委员会(CommitteeonPaymentsandMarketInfrastructures,CPIM)提出“货币之花”对央行数字货币进行了四个关键属性的定义:发行人、货币形态、可获取性、实现技术。如图三所示,央行数字货币是“货币之花”的中心,发行人是央行;实现形式可以是体现传统账户的数字,即基于账户型,或者是基于名下的一串由特定密码学与共识算法验证的数字,即基于价值或基于代币型。根据应用场景不同,又可分为批发端和零售端,前者仅限于资金批发市场,如银行间支付清算、金融交易结算等,后者在社会上流通。 The Payments and Market Infrastructure Committee of the Bank for International Settlements in 2018 (Committeeon Payments and MarketInfrastructures, CPIM) has proposed four key attributes for central bank digital money: “the flower of money”: issuer, currency form, accessibility, and technology. As figure III shows, central bank digital money is the centre of “the flower of money” and the issuer is the central bank; this can take the form of figures that reflect traditional accounts, i.e., account-based or a series of numbers that are validated by specific cryptography and consensus algorithms, i.e., value-based or currency-based. Depending on the field of application, it can be divided into wholesale and retail ends, which are limited to wholesale capital markets, such as bank-to-bank settlement, financial transaction settlement, etc., and the latter moving in society. 央行数字货币特征 Central Bank Digital Currency Characteristics CPIM认为央行数字货币具有以下特征: According to CPIM, the central bank's digital currency has the following characteristics: 可用性:目前传统的央行货币(存款准备金余额)仅限于在中央银行的运行时间内使用,每周7天,每天小于24小时;央行数字货币可以在一天24小时、一周7天或者仅在特定时间使用; Availability: the current traditional central bank currency (deposit reserve balance) is limited to the operation of the central bank for a period of seven days per week, less than 24 hours a day; central bank digital currency can be used 24 hours a day, 7 days a week, or only at specified times; 匿名性:基于代币的央行数字货币,原则上可以以一种类似于私人数字货币的方式提供不同程度的匿名。一个关键的考量是在平衡对中央银行的匿名程度和反洗钱和恐怖主义融资以及个人隐私保护之间的关系; A key consideration is to balance the level of anonymity of central banks with the relationship between anti-money-laundering and terrorist financing and the protection of personal privacy; 转移机制:现金转移是点对点,存款准备金通过中央银行进行转移,央行数字货币通过点对点或中介进行转移,也可通过商业银行或者第三方代理进行转移; Transfer mechanisms: cash transfers are point-to-point, deposit reserves are transferred through the Central Bank, central bank digital money is transferred through point-to-point or intermediary, and may also be transferred through commercial banks or third-party agents; 计息:央行数字货币计息(正或者负)在技术上是可行的; Interest-bearing: Interest-bearing (positive or negative) in central bank digital currencies is technically feasible; 限额或上限:对央行数字货币使用或持有进行量化限额或上限。 Limits or ceilings: Quantified limits or ceilings on the use or holding of central bank digital currencies. 央行现有货币和发行货币的特性 Features of the existing currency of the central bank and the issuing currency 央行数字货币的运行机制 Operating mechanisms for central banks' digital currencies 央行数字货币的发行采取“中央银行—商业银行/其它营运机构”的双层运营体系以及“一币、两库、三中心”的运行框架。双层运营体系的第一层是中国人民银行与商业银行及其它营运机构的直接互动,第二层是商业银行及其它营运机构与个人以及企业等市场参与者之间的交易。第一层,中国人民银行通过商业银行/其它营运机构发行并回笼央行数字货币。第二层,获得央行数字货币的商业银行或其它营运机构对其进行分发,使其在市场上流通。“一币、两库、三中心”的运行框架中的“一币”指央行数字货币,“两库”指人民银行的发行库和商业银行的银行库,“三中心”是央行数字货币的登记中心、认证中心和大数据分析中心。其中,登记中心负责记录发行、转移和回笼央行数字货币全过程的登记。认证中心负责对央行数字货币用户的身份进行集中管理,这是央行数字货币保证交易匿名性的关键,央行数字货币的一个主要问题是要在匿名性和反洗钱和反恐怖融资等监管需求之间做出权衡。大数据中心通过对于支付行为的大数据分析,利用指标监控来达到监管央行数字货币非法用途的目的。 The first level of the two-tier operating system is the direct interaction between the People's Bank of China and commercial banks and other operators, and the second level is the transactions between commercial banks and other operators and market participants, such as individuals and businesses. In the first, the People's Bank of China issues and returns central bank digital money through commercial banks/other operators. 央行数字货币支付生态 Central Bank Digital Currency Payment Ecology 根据第十四届中国支付与场景金融(银行)大会的参与方,数字货币的发行及流通将会影响并涉及以下组织机构:政府、商业银行(信息科技部,风险管理部,数据中心,网络金融部,信用卡中心,资金结算部,运营管理部,计划财务部,电子银行部,零售业务部,普惠金融部)、卡组织、第三方支付企业、收单机构、聚合支付聚合支付、通讯运营商、手机厂商、支付终端、场景支付公司、金融科技公司、区块链、云计算、IT运维、征信、智能风控、大数据、软件解决方案供应商等公司与企业。 According to the participants in the fourteenth Chinese Congress on Payments and Sites, the issuance and circulation of digital money will affect and involve the Government, commercial banks (Ministry of Information Technology, Ministry of Risk Management, Data Centre, Ministry of Cyber Finance, Ministry of Credit Card Centre, Ministry of Funds Settlement, Ministry of Operations, Ministry of Planning and Finance, Ministry of Electronic Banking, Ministry of Retail Operations, Ministry of Inclusive Finance), Organization of Cards, Third Party Payment Enterprises, Receiving Agencies, Collective Payment Payments, Communications Operators, Cellular Operators, Payments Terminals, Site Payment Companies, 2020年10月25日,央行数字货币研究所所长穆长春在外滩金融峰会上明确了数字货币和第三方支付平台的关系,数字货币和支付宝等支付工具,并非处于同一维度。微信和支付宝是金融基础设施,是钱包,而数字人民币是支付工具,是钱包的内容。微信和支付宝是金融基础设施,是钱包,而数字人民币是支付工具,是钱包的内容。在电子支付场景下,微信和支付宝这个钱包里装的是商业银行存款货币,数字人民币发行后,大家仍然可以用微信支付宝进行支付,只不过钱包里装的内容增加了央行货币。同时,腾讯、蚂蚁各自的商业银行也属于运营机构,所以和数字人民币并不存在竞争关系同时,腾讯、蚂蚁各自的商业银行也属于运营机构,所以和数字人民币并不存在竞争关系。并且他还对数字货币运营环节各机构职责做出解释,具体为,在厘清责权利关系的基础上,由作为指定运营机构的商业银行和其他商业银行,以及其他的商业机构比如说第三方支付机构,共同向公众提供数字人民币的流通服务由作为指定运营机构的商业银行和其他商业银行,以及其他的商业机构比如说第三方支付机构,共同向公众提供数字人民币的流通服务。 On October 25, 2020, the Director of the Central Bank's Digital Monetary Institute, Mu Changchun, clarified the relationship between digital money and third-party payment platforms at the Foreign Beach Financial Summit, and between digital money and 虽然目前央行数字货币仍处于试点推广阶段,但经过研究央行数字货币的相关政策文件、权威发言以及试点城市的数字人民币红包的发放和运行方式,我们认为整体央行数字货币的支付生态链将涉及的主要参与方包括商业银行,第三方支付平台/公司,C端用户、商户端和产业服务商,其中第三方支付平台/公司主要提供数字人民币的流通服务和商户数字化升级服务,以及为产业服务商赋能。央行数字货币将通过数字人民币APP渗透第三方支付厂商现有场景,直连C端用户,同时直连或间联第三方支付平台/企业,并由此丰富C端用户支付手段,而为了增强商户客户粘性,第三方支付公司将进一步推动“支付+SaaS”战略,推动商户端的数字化升级,并基于“数据+科技”赋能产业服务商,促进数字经济跨越式发展。 While the central bank digital currency is still in the pilot roll-out phase, following a study of the central bank’s digital currency policy documents, authoritative statements, and the way in which the pilot city’s digital renminbi is issued and operated, we believe that the main players involved in the entire central bank’s digital currency payment ecological chain will include commercial banks, third-party payment platforms/companies, C end-users, business end-user and industry service providers, with third-party payment platforms/companies providing mainly digital currency mobile services and business upgrading services, as well as industrial service providers. The central bank’s digital currency will filter through the digital currency’s APP into existing third-party payment vendor scenarios, connecting C end-end users to C end-end payment platforms/enterprises, and thereby enrich C end-user payment instruments. In order to enhance business customer stickyness, the third-party payment company will further the “payment + Saa’s” strategy, promote digital upgrading at the commercial end, and promote & nbsp; $Z002197 & nbsp; & nbsp; SZ300546$ & nbsp;

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论