原创 PAData PANews

Original PAData PANews

策划 | Carol 编辑 | Tong 视觉设计 | Tina Cyan

Planning Carol Edit Tong Visual Design Tina Cyan

出品 | PANews

P.A.News.

“连续性”是哲学话语中对事物发展性质的一种描述。任何事物的发展都是连续的,区块链也不例外。

“Continuity” is a philosophical description of the developmental nature of things. Everything goes on and on and on and on and on.

2020年,区块链领域出现了很多新的发展动向。首先,最引人注目的是比特币在这一年的年末不断刷新历史新高,最后一天以超29800美元的历史最高价“收官”。其次,以太坊上的DeFi生态迎来大爆发,不仅自身锁仓总额实现2100%的增长,推动概念币普涨191%,而且还使以太坊的链上交易次数同比增长41.98%,是比特币的近3倍。除此之外,在这一年里,包括比特币在内的12个区块链迎来减产;Polkadot等明星公链接连上线主网;期货和期权等金融衍生品有所发展;以灰度为代表的机构资金持续入场;全球监管部门收紧对法币稳定币和首次发行代币的监管……

In 2020, there were a number of new developments in the area of block chains. First, the most striking is that Bitcoin kept its history up at the end of the year, “collecting officials” on the last day at the historical highest price of more than $29,800. Second, a massive break-up in the DeFi ecology of the courthouse led to a growth of not only 21% in its own total lock-up, an increase of 191% in the conceptual currency, but also to an increase of 41.98% in the number of transactions in the district, nearly three times the amount of Bitcoin. In addition, 12 blocks, including Bitcoin, were cut off during the year; star public links, such as Polkadot, were connected to the main network; financial derivatives, such as futures and options, were developed; institutional funds, represented by greyscale, continued to enter the field; global regulatory authorities tightened their regulation of French currency stability and the first issuance of sub-currencys...

这些动向必将延续至2021年。

These developments will continue until 2021.

站在时间的交叉口上,PAData与来自CoinGecko、Messari、Nansen、Arcane Research、PeckShield、OKEx研究院和Gate.io研究院这7家独立研究机构的分析师一起,解读2020年区块链领域的重要数据,并就此展望2021年的趋势。

At the intersection of time, PAData worked with analysts from seven independent research institutions, CoinGecko, Messari, Nansen, Arcane Research, PeckShield, OKEx and Gate.io, to interpret key data in the area of block chains in 2020 and to see trends in 2021 in this regard.

我们认为,BTC在2021年有望保持高位运行甚至进一步上涨,与上一轮牛市的两个阶段相比,本轮牛市在第一阶段的回报率更高,这为第二阶段的走势奠定了基础。另一方面,机构资金持续加码,第三次减产导致矿业收入结构转变等因素将为第二阶段的走势提供动力。

In our view, BTC is expected to remain high and even to increase further in 2021, with the first-stage rate of return being higher than in the two phases of the previous round, laying the foundation for the second-phase movement. On the other hand, the second-phase trend will be driven by factors such as the continued build-up of institutional funds and the structural transformation of mining revenues as a result of the third cut in production.

我们还认为,2021年DeFi或将有机会受益于更广泛的金融科技从而进一步扩大用户规模。DeFi衍生品领域领域可能迎来突破。生态发展与区块链基本面的持续改善将形成正反馈机制,这为未来ETH的新价值共识提供了基础。但要注意防范DeFi“乐高”组合下的系统性风险。

We also believe that, in 2021, DeFi will have the opportunity to benefit from a wider range of financial technologies to further expand the size of its users. The area of deFi derivatives is likely to break.

数据:303% vs 130%

data: 303% vs 130%

关键词:BTC、回报率

市场研究员:CoinGecko / Erina Azmi

Market Researcher: CoinGecko/Erina Azmi

2016-2018年的周期见证了比特币价格的增长,峰值回报达到了4527%的,第一阶段(2016/01/01-2017/01/01)回报率约为130%。而在2020-2022年的周期中,比特币第一阶段(2020/01/01-2021/01/01)的回报率达到了330%,比上一个周期高出了一倍多。在本次周期中,加密货币市场能维持高估值,在很大程度上是由于机构的涌入、鼓励宽松货币政策的宏观环境和市场可触及性的进一步扩大。

The 2016-2018 cycle witnessed the growth of Bitcoin prices, with a peak return of 4527%, with the first phase (2016/01-2017/01/01) yielding about 130%. In the 2020-2022 cycle, Bitcoin’s first phase (2020/01-2021/01/01), with a return of 330%, was more than double the previous cycle.

关于更多BTC的年度数据可以参考。

More annual data on BTC are available.

数据:2倍

data: 2 times

关键词:以太坊、交易量

keyword: in Taiwan, transaction volume

高级分析师:Messari / Ryan Watkins

Senior Analyst: Messari / Ryan Watkins

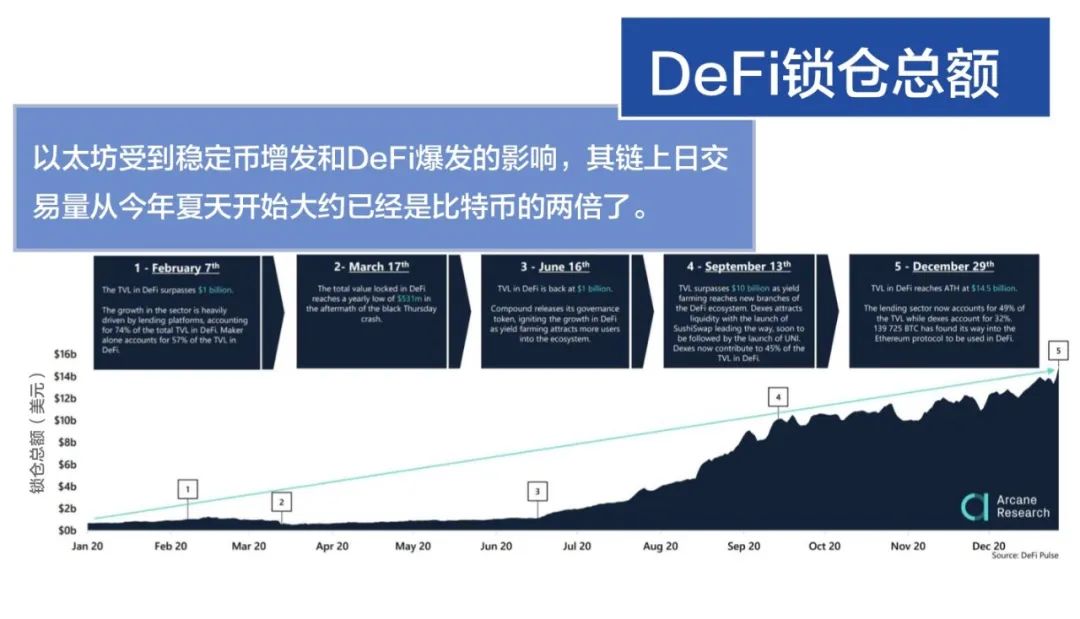

在2020年第三季度,以太坊的日交易量逐渐超过比特币,截至9月底已大约是比特币的两倍。这是以太坊链上经济取得进展的一个令人难以置信的迹象。DeFi和稳定币是过去一年实现这一目标的两个关键进展。

In the third quarter of 2020, the daily volume of trade with Taiku gradually exceeded that of Bitcoin, roughly twice as much as it was at the end of September. This is an incredible sign of economic progress in the Taiyeon chain.

关于更多以太坊链上年度数据可以参考。

More annual data on the Etherm chain can be consulted.

数据:70%

data: 70%

关键词:以太坊、Gas、Gas Token

keyword: In Taiwan, Gas, Gas Token

CEO:Nansen / Alex Svanevik

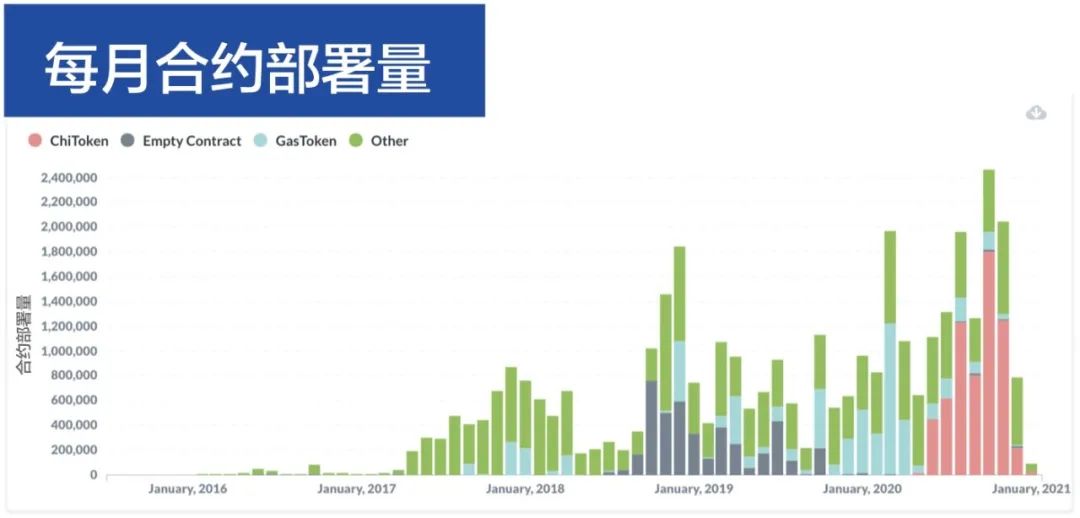

2020年属于ChiToken,因为它在以太坊主网合约部署方面的表现比GasToken更好。10月份是ChiToken合约部署最活跃的月份,180万份ChiToken合同被部署到以太坊上,占当月合约总量的70%以上。

The year 2020 belonged to ChiToken, because it performed better than GasToken in terms of the deployment of the Ethionet contract. In October, the most active month for the ChiToken contract, 1.8 million ChiToken contracts were deployed to Ethio, accounting for more than 70% of the total contract.

我认为,在2021年,DeFi将和FinTeck结合,这将推动DeFi进一步“破圈”。另外我还认为最流行的DeFi将在会推出Layer2解决方案,这样它们就可以随着更多用户进入该领域而扩大规模。

I think that in 2021, DeFi will join FinTeck, which will push DeFi to “break the circle” further. I also think that the most popular DeFi will launch the Layer2 solution, so that they can be scaled up as more users enter the field.

关于以太坊Gas费的更多年度数据可以参考。

More annual data on Ethio Gas fees are available.

数据:2100%

data: 2100%

关键词:DeFi、锁仓额、衍生品

keyword: DeFi, warehouse locks, derivatives

研究总监:Arcane Research / Bendik Norheim Schei

Director of Research: Arcane Research / Bendik Norheim Schei

2020年上半年,DeFi领域得到了适度的应用,其中借贷协议占据了主导地位。彼时DeFi的总锁仓量大约稳定在7亿至10亿美元之间。随后,Compound在6月推出了治理代币,流动性挖矿引爆了DeFi的收益,越来越多的“农民”加入DeFi。纵观全年,DeFi的总锁仓量从6.7亿美元增加到145亿美元,增长了2100%。另外,截至12月,DeFi共有100万个独立地址,比1月份增长了10倍。

In the first half of 2020, the DeFi area was applied proportionately, with borrowing agreements taking the lead. By contrast, DeFi’s total lock-down was stable at around $700 million to $1 billion. Subsequently, Compound introduced a governance currency in June, liquid mining detonated the proceeds of DeFi, with an increasing number of “farmers” joining DeFi.

在2021年,我们认为,收紧对中心化衍生品交易市场的监管将引导交易者转向替代市场,DeFi衍生品平台将出现更大幅度的增长。

In 2021, we believe that tighter regulation of the centralized derivatives trading market will lead traders to alternative markets and that the DeFi derivatives platform will grow even more dramatically.

关于更多DeFi年度数据可以参考。

More annual data on DeFi can be consulted.

数据:$2.37亿

关键词:DeFi、攻击、系统风险

研究员/技术负责人:PeckShield / 施华国

Researcher/Technologist: PeckShield/Schwar

自今年 2 月起,bZx 协议遭到闪电贷攻击,针对 DeFi 项目的攻击就开始爆发。由于 2020 年 DeFi 项目的组合玩法越来越多,项目组合导致的风险也愈来愈大,到 11 月达到了一个攻击事件和损失金额的高点。据 PeckShield(派盾)统计发现,造成损失最严重的 DeFi 攻击类型有三种:预言机、闪电贷、重入攻击;仅 2020年11月26日,Compound 协议遭预言机攻击就有 9000 万美金资产被清算。

Since February of this year, the bZx agreement was attacked by a flash loan, and the attack on the DeFi project began. As a result of the growing combination of the DeFi project in 2020, the risk of the portfolio has increased, reaching a high point in November in terms of the number of attacks and the amount of damages.

关于更多DeFi年度数据可以参考。

More annual data on DeFi can be consulted.

数据:248%

data: 248%

关键词:BTC期货、未平仓总额

keyword: BTC futures, unscathed total

首席研究员:OKEx研究院 / William

Principal Researcher: OKEx Institute / William

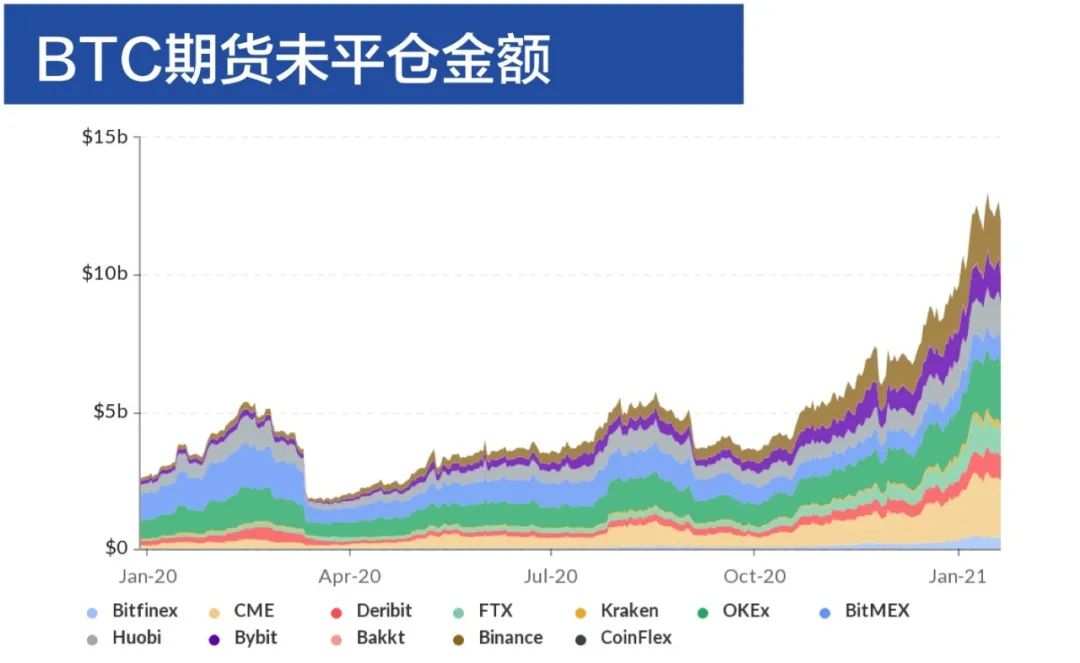

2020年比特币期货合约的持仓量从约27亿美元上涨至约94亿美元,涨幅达到248.15%。随着12月比特币价格不断创新高,期货的持仓量和交易量也随之创出新高。全年期货市场呈现出两大特征:第一,CME上的比特币期货合约持仓量一直排市场的第一、二名,机构投资者交易频率低,持仓时间长;第二,在年末的牛市行情下,进入加密衍生品市场的投资者多为中小投资者,而非机构投资者。

In 2020, the stock of futures contracts in Bitcoin rose from about $2.7 billion to about $9.4 billion, an increase of 248.15%. As the price of Bitcoins grew in December, so did the stock and volume of futures.

关于BTC更多市场交易数据可以参考。

Additional market transaction data on BTC can be consulted.

数据:$174亿

关键词:灰度、GBTC、OTC高溢价

keyword: Greyscale, GBTC, OTC high premium

研究员:Gate.io研究院 / Zian Zeng

Researcher: Gate.io Institute / Zian Zeng

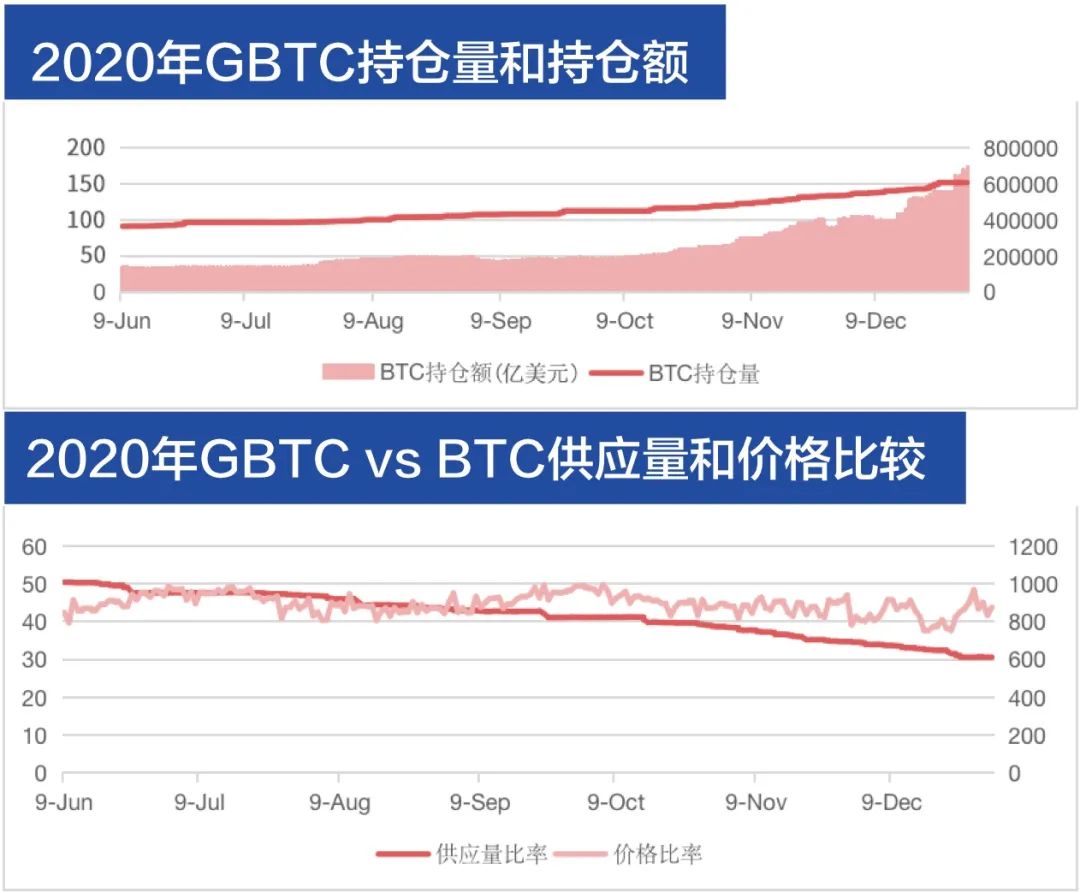

2020年,灰度BTC信托规模不断扩大,截至年末已达到174.75亿美元。同时,在同类产品中,GBTC的市场份额与比特币的市值呈现同期增长,这佐证了信托资金的流入是今年影响比特币大涨的一个因素。另外,BTC/GBTC的价格比整体稳定,但供应量比率衰减明显,这意味着,在保持同期价格增长的情况下,比特币供应量的增长大于GBTC信托份额的创建,这在一定程度上解释了GBTC的高溢价现状。根据统计,GBTC在下半年的最高溢价超过40%。

In 2020, the Greyscale BTC Trust grew in size, reaching $17,475 million by the end of the year. At the same time, the market share of the GBTC in products of the same kind increased in the same time as the market value of Bitcoin, confirming that the inflow of trust funds was one of the factors influencing the significant increase in Bitcoin this year. In addition, BTC/GBTC prices were more stable than overall, but the supply ratio declined significantly, meaning that, while maintaining price growth over the same period, the increase in the Bitcoin supply was greater than the creation of the GBTC share of the GBTC Trust, which partly explained the high premium of the GBTC.

更多灰度信托基金的数据可以参考和。

More greyscale trust fund data are available for reference and comparison.

数据:-3.78%

data: 3.78%

关键词:比特币减产、矿业、手续费比重

keyword: Bitcoin cutbacks, mining, fee weight

高级数据分析师:PANews / Carol

Advanced Data Analyst: PANews/Carol

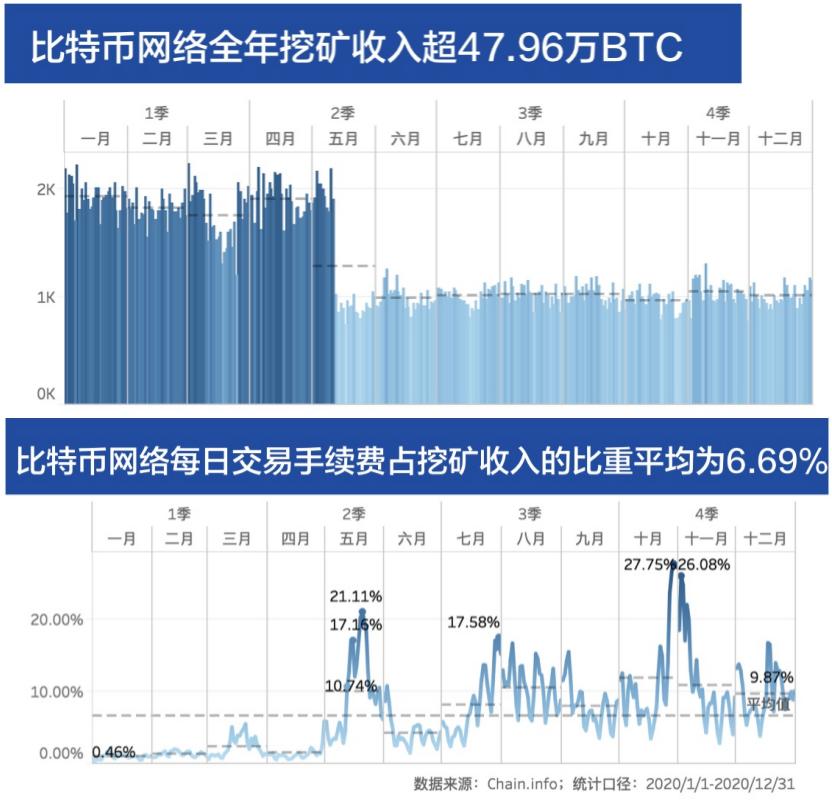

2020年比特币矿业规模缩小,全年矿业累计产出金额约为50.12亿美元,较2019年“缩水”3.78%。一方面,这受到第三次减产的影响,区块链奖励下降50%。另一方面,尽管交易手续费大幅增长,全年手续费收入超3.26亿美元,较2019年上涨108.97%,交易手续费占矿业总收入的比重也从去年的平均2.8%扩大至今年的平均6.69%,但这仍然不能弥合区块奖励减少带来的收入落差。

The reduction in the size of the Bitcoin mining industry in 2020, with a cumulative output of approximately $5.012 billion for the year as a whole, compared with 3.78 per cent in 2019. On the one hand, this was affected by the third reduction, with a 50 per cent decline in block-chain incentives. On the other hand, despite a significant increase in transaction fees, which exceeded $326 million for the year by 108.97 per cent compared to 2019, the share of transaction fees in total mining revenues also increased from an average of 2.8 per cent last year to an average of 6.69 per cent in the year to date, but this still does not bridge the income gap resulting from the reduction in block incentives.

手续费大幅上调成了改善矿业边际利润的主要途径。如果明年币价不能稳定在较高位置,交易手续费或将继续大幅上升。反过来,作为行业基础生态的矿业规模将为BTC价值提供一种支撑。

If currency prices are not stabilized at higher levels next year, transaction fees may continue to rise significantly. In turn, the size of the mining industry as the backbone of the industry will support the BTC’s value.

原标题:《我们邀请了全球8位分析师把脉2021,这8个数据你需要了解》

Original title: We've invited 2021 analysts from around the world, and you need to know about these eight data.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论