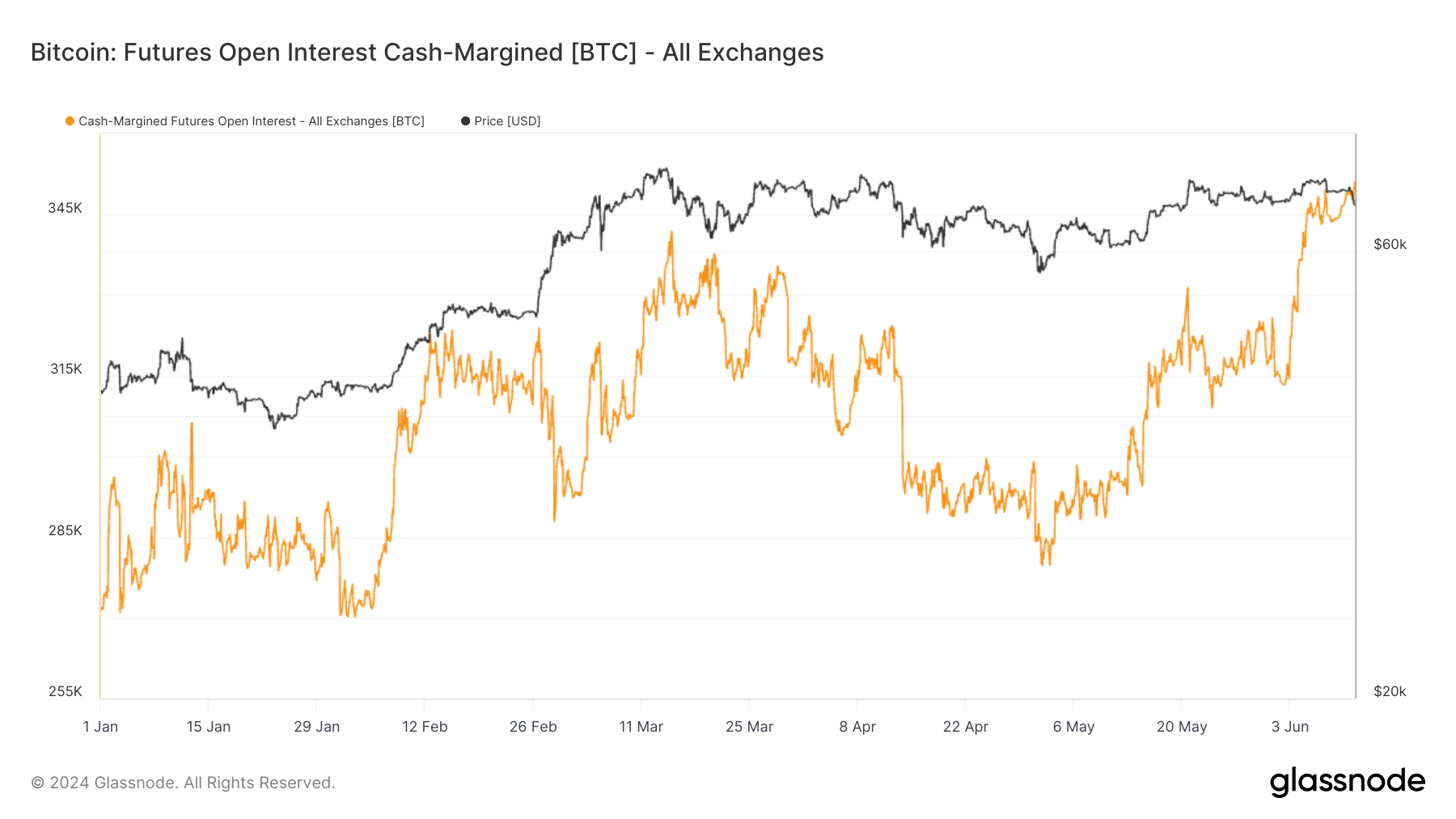

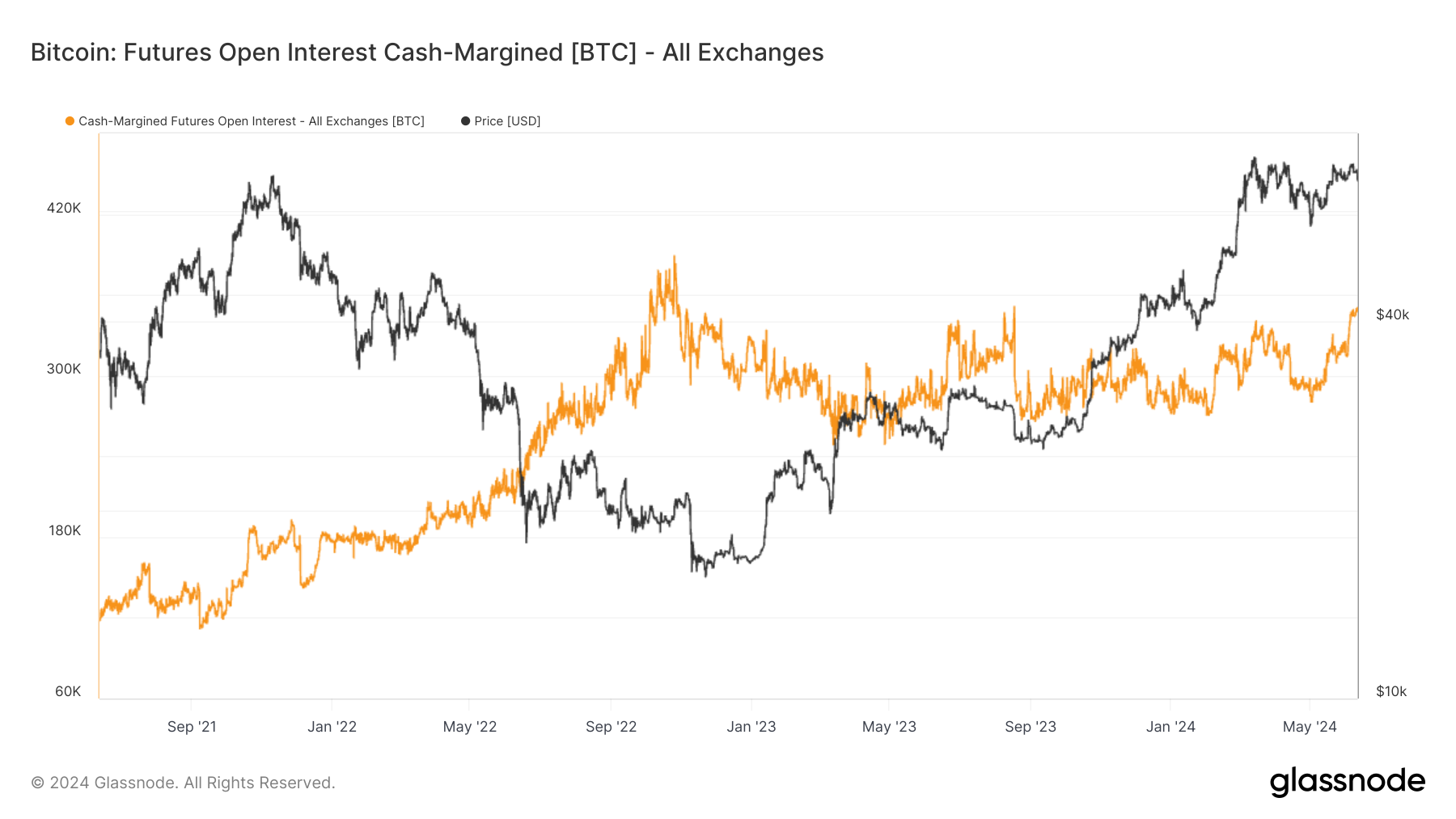

比特币期货中现金保证金合约的使用量大幅增加。Glassnode 的数据显示,各交易所的现金保证金期货未平仓合约大幅增加,截至 6 月 11 日已升至 345,000 BTC 以上。

bitcoin futures contracts have increased significantly. Glasnode's data show that cash guarantee futures have increased significantly to 345,000 BTC as at 11 June.

这比年初的 260,000 BTC 现金保证金期货未平仓合约有显著增长。这一增长反映了更广泛的市场趋势,即降低风险和偏好抵押品稳定性。

This represents a significant increase from the 260,000 BTC cash guarantee futures outstanding contracts at the beginning of the year. This increase reflects a broader market trend, namely, risk reduction and preference for collateral stability.

CryptoSlate 早前的分析发现,期货合约从比特币保证金转向现金保证金。这一变化归因于交易者越来越倾向于使用美元和稳定币作为抵押品,以避免加密货币固有的波动性。

Crypt oSlate early analysis found that futures contracts from bitcoin guarantee. This change is due to the increasing tendency of traders to use the United States dollar and stable currency as collateral to avoid the inherent volatility of encrypted currencies.

这一趋势被视为市场成熟的标志,在高度波动的期货市场中,人们更加重视稳定性和风险管理。

This trend is seen as a sign of market maturity, with greater emphasis on stability and risk management in highly volatile futures markets.

现金保证金期货的增加也可能受到 2024 年 4 月比特币减半事件的影响,该事件历来对市场趋势和交易策略产生了重大影响。

The increase in cash guarantee futures may also be affected by the halving of the Bit currency in April 2024

随着交易者和投资者继续适应这些变化,整体市场结构将朝着波动性较小的投资机制发展。正如 CryptoSlate 之前指出的那样,这一发展对于吸引更多优先考虑投资组合稳定性和风险管理的机构投资者至关重要。 As traders and investors continue to adapt to these changes, the overall market structure will move toward less volatile investment mechanisms. As CryptoSlate noted, this development is essential to attract more institutional investors that give priority to portfolio stability and risk management. Title of article: bitco futures show significant growth in cash bond contracts 文章链接:https://www.btchangqing.cn/658193.html 更新时间:2024年06月12日 Update: 12/06/2024

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论