文 | 财联社 刘蕊

Wen Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei Wei

比特币周四经历“高台跳水”:在连续大涨多日升破19000美元,逼近历史高位之际,突然单日一度大跌近3000美元至16590美元左右,跌幅近13%。

Bitcoin went through a “high jump” on Thursday: at a time when it had risen by many days, reaching historic heights of $19,000, it suddenly fell by almost $3,000 to $16,590 on a single day, or by almost 13 per cent.

分析师指出,比特币的下跌是由于比特币杠杆化过热,同时技术面出现回调,而一些利空消息引发的担忧又放大了这一下跌趋势。

According to analysts, the decline in bitcoin was due to the overleveraging of bitcoin and a backlash on the technical side, a downward trend magnified by concerns raised by a number of sources.

部分分析师认为,比特币昨日的下跌只是“上涨趋势中的短暂回调”,随着过度杠杆作用被消除,比特币可能以更具可持续性的涨势创下历史新高。

According to some analysts, the decline in Bitcoin yesterday was only a “temporarily upturn” and, as excessive leverage was eliminated, Bitcoin may have reached an all-time high with a more sustainable upturn.

1.比特币过度杠杆化

Stack Funds首席执行官马修?迪布(Matthew Dibb)表示:“比特币已经成为主要交易所上市的衍生品杠杆交易大规模平仓的受害者。”

Chief Executive Officer of Stack Funds, Matthew Dibb, stated that “bitcoin has become a victim of large-scale unwinding of derivatives trading on the main exchange”.

根据数据来源Bybit的数据,截至周四晚间12:00,近20亿美元的衍生品头寸在之前24小时内被平仓。其中,价值超过16亿美元的交易在之前12小时内被关闭,

According to the data source Bybit, nearly $2 billion of derivative positions had been levelled in the previous 24 hours as of Thursday night at 12 noon. Of this amount, transactions worth more than $1.6 billion had been shut down within the previous 12 hours.

这些杠杆交易的平仓早在预料之中,因为在比特币期货市场持有多头头寸的成本,也就是资金费率,在过去几天已大幅上升至数月高点0.098%,这是一种市场过度杠杆化或过热的迹象。

The levelling of these leveraged transactions was long anticipated, as the cost of holding multiple positions in the Bitcoin futures market, i.e., the financial rate, had risen significantly over the past few days to a few months'height of 0.098 per cent, a sign of overleveraging or overheating of the market.

所谓资金费率,是指交易者因持有头寸而需要支付或收取的费用,通过这笔费用可以实现市场的多头和空头方之间平衡,使得某个合约可以密切跟随其标的资产的价格。举例来说,如果比特币/美元的永续合约在高于比特币现货价格处交易,则资金费率为正,那么多头交易者就需要向空头交易者支付费用,以实现抑制多头头寸、激励空头头寸的目的。反之亦然。

For example, if the Bitcoin/United States dollar is traded above the spot price of Bitcoin, the money rate is positive, and so many traders are required to pay the fee to the empty traders in order to achieve the goal of containing the multiple positions and stimulating the empty positions. The reverse is also true.

根据数据源Glassnode的数据,随着比特币价格的下降,比特币的资金费率已经回落到0.011%。这意味着比特币市场过度的杠杆已经被挤出市场了。

According to data source Glasnode, with the fall in bitcoin prices, bitcoin’s funding rate has fallen back to 0.011%. This means that bitcoin’s excessive leverage has been squeezed out of the market.

2.技术面回调

过去七周,比特币从1万美元飙升至1.94万美元,从技术图表上看,涨势有些过度。尽管14日相对强弱指数(RSI)已经显示超买,但比特币在整个上升过程中仍一直保持在10日均线上方。

In the past seven weeks, Bitcoin has skyrocketed from $10,000 to $19.4 million, which is somewhat excessive in terms of technical charts. Although the relative strength and weakness index (RSI) of 14 days has shown overpurchase, Bitcoin has remained above the average of 10 days throughout the rise.

历史上,资产价格很少出现90度的上涨,因为投机者往往会定期锁定获利,将价格推至短期移动平均线下方。在之前的比特币牛市中,也都出现过几次20%甚至更大幅的回调。

Historically, asset prices have rarely risen by 90 degrees, as speculators often regularly lock in profits, pushing prices below the short-term moving average. In the previous Bitcoin cattle market, there were several 20% or even larger returns.

“今天看到的价格下跌使加密货币跌至10日均线下方,RSI重新调整,以一种更友好的方式看多。”Stack Funds的Dibb表示,"这是一次健康的回调。"

"The price decline seen today has caused the encrypt currency to drop below the 10-day average, and RSI has been readjusted to see more in a more friendly way." The Dibb of Stack Funds says, "This is a healthy return."

根据技术分析师的分析,规律回调的价格涨势比近90度的极端上涨更具可持续性。

According to the analysis of the technical analysts, the price increase of the regular roundback is more sustainable than the extreme increase of nearly 90 degrees.

3. 消息面刺激放大下跌趋势

此外,还有一些消息面的因素刺激了比特币的抛售。

In addition, there were a number of sources that stimulated the sale of Bitcoin.

北京时间26日8点前后,数字货币交易所Coinbase联合创始人Brian Armstrong连发十几条推特,表示美国财长姆努钦正计划在任期结束前出台有关“自托管加密钱包”的新规。

Around 8 p.m. Beijing time, Brian Armstrong, a co-founder of the Digital Currency Exchange Coinbase, tweeted more than a dozen tweets, saying that US Chancellor of Finance Munuchin was planning to introduce a new regulation on self-hosting encrypted wallets before the end of his tenure.

据称,这项新规试图跟踪加密货币钱包的所有者和参与交易的每个人员,如果得以实施,会压制加密货币精神的核心原则——私有加密货币不受骚扰和跟踪。

It is alleged that this new regulation, which attempts to track the owners of encrypted currency wallets and every person involved in the transaction, if implemented, will suppress the core principle of the ethos of encryption — private encrypted money free from harassment and stalking.

“在乐观情绪和不可持续的高杠杆背景下,这种(监管担忧)引发了3月份以来最大的单日跌幅。”分析师克鲁格表示,“如果阿姆斯特朗所说的成为现实,那将是非常悲观的。但到目前为止,我认为在短期内这是极不可能的。”

“In the context of optimism and unsustainable high leverage, this (regulatory concern) triggered the largest single-day fall since March.” The analyst Krueger said, “If what Armstrong says is true, it would be very pessimistic.

此外,知名加密货币交易所OKEX宣布恢复取款业务,也放大了比特币的下跌趋势。

In addition, the announcement by the well-known crypto-currency exchange, OKEX, to resume the withdrawal business has also magnified the downward trend in Bitcoin.

10月16日OKEX冻结了所有取款业务。5周后,国际标准时间本周四8:00(北京时间16:00),OKEX恢复取款业务。

On 16 October, all withdrawal operations were frozen.

“大部分(在OKEX平台)被冻结的比特币(在这5周内)已经上涨了近70%,有很多未被兑现的利润被锁定在里面……一旦这些比特币可以被兑换,很多交易者们都会选择将他们兑换为美元或稳定货币,这就加大了抛售的势头。”CME加密指数提供商CF Benchmarks的首席执行官Sui Chung表示。

“Most of the frozen bitcoins (in the OKEX platform) have increased by almost 70 per cent (in these five weeks) and many of the unrealized profits have been locked in... Once these bitcoins are convertible, many traders will choose to convert them into United States dollars or stable currencies, which increases the momentum for sale.” According to Sui Chung, chief executive officer of CME encryption provider CF Benchmarks.

当比特币交易所在北京时间周四16:00恢复取款交易时,比特币价格已经跌至约1.76万美元,并在随后的一小时内跌至1.66万美元。

When the Bitcoin exchange resumed its withdrawal transaction on Thursday, 16:00, Beijing time, the Bitcoin price had fallen to approximately $176,000 and to $16.6 million in the following hour.

分析师:比特币上涨趋势仍未结束

一些分析师认为,昨日比特币的下跌仅是比特币上涨趋势中的短线回调,看涨比特币的宏观因素(如机构对比特币的参与度增加、全球央行放水等)仍然完好无损。

According to some analysts, yesterday’s decline in bitcoin was merely a short retrenchment in the upward trend of bitcoin, and the macro-factors of the increase in bitcoin (e.g. increased institutional participation in bitcoin, global central bank water release, etc.) remain intact.

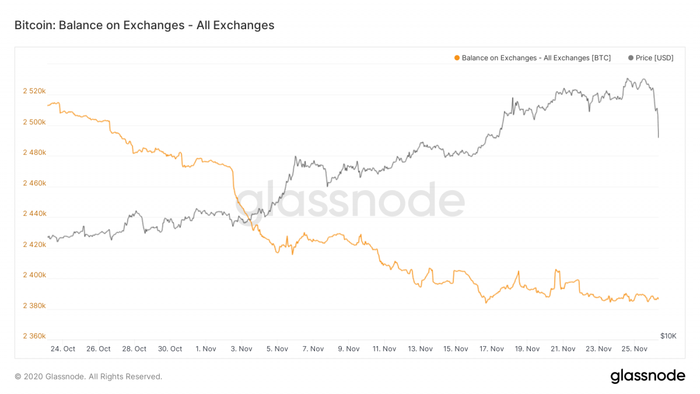

根据权威区块链数据平台Glassnode的数据,截止目前,投资者对比特币的持有情绪仍然强劲。目前全球加密货币交易所持有的硬币数量为238万枚,这是自2018年8月以来的最低水平。

According to the authoritative block chain data platform, Glasnode, investor holdings of Bitcoin remain strong to date. The number of coins held by the global encrypted currency exchange is currently 2.38 million, the lowest since August 2018.

分析师认为,周四的比特币价格暴跌已经消除了过度的杠杆作用。随着持有多头头寸的成本正常化,比特币可能以更具可持续性的涨势创下历史新高。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论